Agriculture Growth and Prospect

Agriculture has long been the cornerstone of Indonesia’s economy, making up around 12% of the nation’s GDP and providing livelihoods for nearly one-third of its workforce. Staples like rice, corn, palm oil, coffee, and rubber dominate the landscape produced predominantly by millions of smallholder farmers who form the backbone of rural communities.

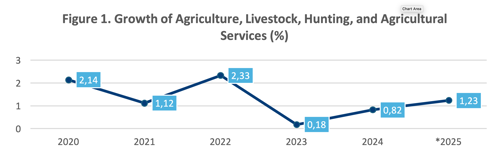

Between 2020 and 2025, Indonesia’s agriculture sector has experienced fluctuating growth rates shaped by various challenges and recovery efforts. In 2020, despite the global upheaval caused by the COVID-19 pandemic, the sector showed resilience with a 2.14% growth rate as demand for food remained steady. However, in 2021, growth slowed to 1.12%, hindered by supply chain issues and adverse climate impacts. The sector bounced back in 2022, achieving a 2.33% growth thanks to favorable weather and government stimulus programs. Unfortunately, this momentum slowed sharply in 2023 to only 0.18%, as El Niño disrupted rainfall patterns, severely affecting rice and other crop yields.

In 2024, Indonesia’s agricultural sector showed signs of recovery with a growth rate of 0.82%, largely driven by early adoption of digital agriculture technologies and increased investments in modern farming methods. Projections for 2025 anticipate a further increase to 1.23% growth, reflecting cautious optimism fueled by ongoing digital transformation initiatives, expansion of cultivated land, and improved climate resilience measures. These figures illustrate a sector vulnerable to external disruptions but increasingly poised for sustainable growth through innovation and supportive policies. Nonetheless, challenges such as fragmented landholdings, low productivity levels, and limited technology access remain significant hurdles. The government’s focus on digitalization and modernization presents substantial opportunities for AgriTech development, with potential benefits including enhanced operational efficiency, greater food security, and improved export competitiveness.

Overview AgriTech

AgriTech plays a vital role in advancing Indonesia’s agricultural sector by boosting productivity and operational efficiency. It encompasses the use of modern technologies and digital innovations to enhance production processes, optimize resource use, and improve the quality of agricultural outputs. Key technologies include the Internet of Things (IoT), Artificial Intelligence (AI), drones, soil sensors, and digital platforms that facilitate land management and crop distribution.

In countries with highly developed agricultural sectors such as the United States, the Netherlands, and Israel, AgriTech is deeply integrated into farming practices. These nations utilize robotics, precision irrigation, and big data analytics as standard tools in commercial agriculture. Their robust digital infrastructure and innovation ecosystems support rapid technology adoption, while government policies actively encourage sustainable AgriTech development.

Conversely, in developing countries like India, Brazil, and Indonesia, AgriTech adoption is rising with a focus on scalable solutions for small to medium-sized farmers. Nonetheless, these countries face challenges such as inadequate infrastructure and limited digital literacy, which hinder wider implementation.

Implementation and Adaptation of Agritech in Indonesia

In the past three years, the adoption of digital technology in Indonesia’s agricultural sector has shown significant progress. One of the key milestones is the emergence of digital platforms such as:

a. TaniHub

b. eFishery

c. Crowde

This platform provides farmers with direct access to markets, input suppliers, and microfinancing. These platforms have tangibly helped increase the selling value of agricultural products and accelerated financial inclusion in the sector.

Additionally, the use of Internet of Things (IoT) technology has begun to be adopted by some farmer groups and government projects, including soil moisture sensors, automated rainfall measuring devices, and GPS for land mapping. These technologies support data-driven decision making.

Alongside this, precision farming approaches have started to be introduced in several major agricultural regions. By applying fertilization and spraying based on land-specific needs, this practice has successfully reduced input waste and improved overall farm efficiency.

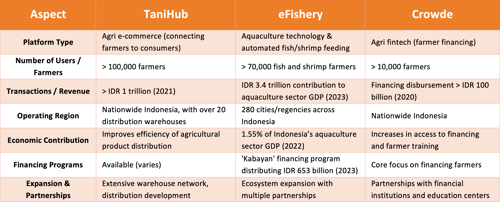

TaniHub, eFishery, and Crowde are three agritech platforms with different but complementary roles supporting Indonesia’s agriculture and aquaculture sectors. TaniHub helps farmers sell their products directly to consumers, expanding their market reach across the country. Meanwhile, eFishery offers automated feeding technology that makes fish and shrimp farming more efficient and productive, providing real impact to the aquaculture industry. Crowde focuses on giving farmers access to financing, especially those who struggle to get formal credit, along with training to help improve their yields.

All three platforms have been growing rapidly in terms of users and transaction volumes. They’ve also built strong strategic partnerships to strengthen the overall agricultural ecosystem. Together, they’re improving efficiency, opening wider market access, and making financing easier all of which help drive progress in Indonesia’s farming sector.

Results of Agritech Platform Use

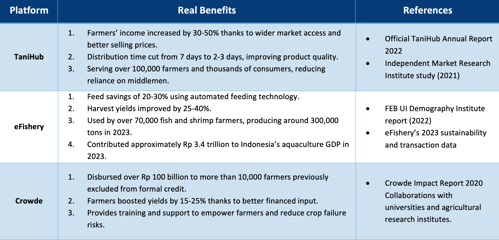

The three AgriTech platforms in Indonesia such as TaniHub, eFishery, and Crowde have delivered significant tangible benefits to farmers and agribusiness players in the agriculture and aquaculture sectors. TaniHub has successfully increased farmers’ incomes by 30-50% by expanding market access and reducing distribution time, resulting in fresher products. eFishery leverages automated technology to save 20-30% on feed costs and improve harvest yields by 25-40%, making a substantial contribution to Indonesia’s aquaculture economy. Crowde provides credit access to farmers who previously faced financing barriers, helping to boost crop yields by 15-25% while also offering training to mitigate crop failure risks.

The integration of technology and financial inclusion through these platforms addresses critical bottlenecks in Indonesia’s agricultural value chain. By improving market connectivity, reducing post-harvest losses, and providing affordable financing, these solutions empower farmers to optimize their production and profitability. This holistic approach not only boosts individual farmer welfare but also strengthens the overall resilience and competitiveness of the sector.

Moreover, reducing reliance on middlemen leads to more transparent pricing and fairer revenue distribution, which encourages long-term investment in farming activities. With the continuous adoption of such innovations, Indonesia is well-positioned to accelerate its agricultural modernization, increase food security, and create inclusive economic growth for rural communities.