Southeast Asia (ASEAN) has become a major magnet for global investors. With its economic stability and vast growth opportunities, the region offers immense potential for sustainable growth. According to the 2023 IMF World Economic Outlook, the total GDP of ASEAN countries is expected to reach USD 3.94 trillion in 2023, accounting for nearly four percent of the year's estimated global GDP.

With a population exceeding 660 million, ASEAN is the third-largest economy in Asia and the fifth-largest globally, following the United States, China, Japan, and Germany. ASEAN’s GDP is projected to grow to USD 4.5 trillion by 2030, positioning the region as the world’s fourth-largest economy and reinforcing its sustained economic growth and increasing global influence, as noted in the ASEAN Statistical Brief Volume IV, January 2024.

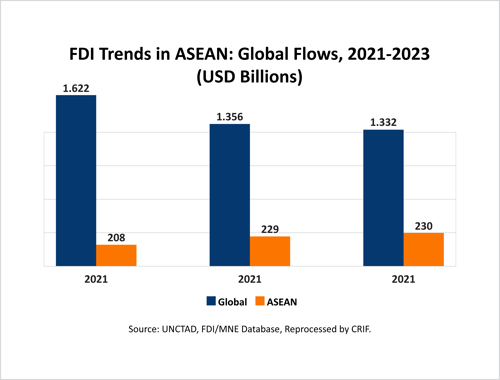

The rapid inflow of foreign capital into Southeast Asia presents the region as a magnet for global investment. Despite the challenges posed by the COVID-19 pandemic, ASEAN’s swift recovery and economic reforms have rebuilt investor confidence. According to data from UNCTAD, foreign direct investment (FDI) in Southeast Asia reached USD 229.8 billion in 2023, showing a modest increase of 0.3% from USD 229.2 billion in 2022. This represented 17% of total global FDI flows.

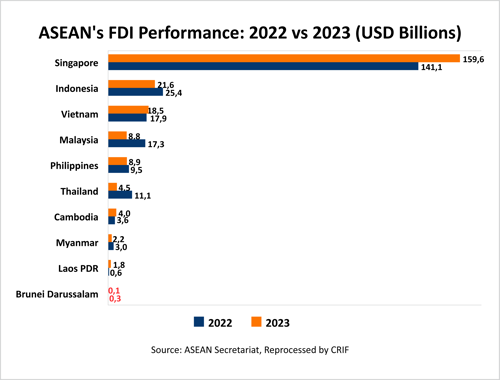

While global FDI flows have been hindered by worsening geopolitical tensions and slowing global economic growth, ASEAN remains an attractive investment destination. In 2023, six of the ten ASEAN member countries saw higher FDI inflows. Singapore led the region, attracting USD 159.67 billion, representing 71% of the total FDI flowing into ASEAN. Indonesia followed as the second-largest recipient with USD 21.63 billion, contributing 10% of the total FDI in ASEAN. One of the largest foreign investments in Indonesia is the USD 9 billion electric vehicle battery industry. In contrast, Brunei Darussalam was the only ASEAN country to experience negative FDI in 2023, signaling disinvestment or declining foreign capital.

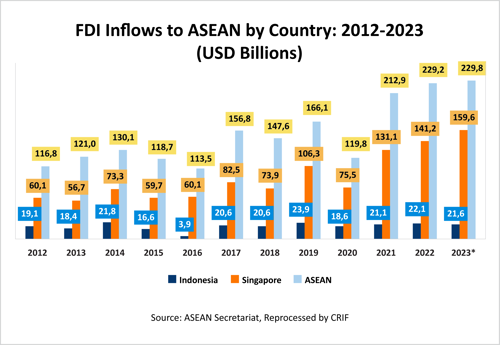

Singapore’s FDI is three times that of Indonesia. This is largely due to Singapore’s status as the only developed country in Southeast Asia, with the highest per capita income in ASEAN. While Indonesia’s FDI has been relatively stagnant since 2012, the growth rate is modest. In 2012, Indonesia's FDI was USD 19.1 billion, fell sharply to USD 3.9 billion in 2016, and stood at USD 21.6 billion in 2023.

The average FDI for Indonesia over the past 12 years has been USD 19 billion, accounting for 21% of Singapore's average FDI of USD 90.6 billion. This means Singapore’s FDI is 476% (or 4.7 times) higher than Indonesia’s.

Indonesia can learn valuable lessons from Singapore on how to attract foreign investment. Singapore has optimized its economy to attract FDI by creating a conducive business environment. This includes favorable loans for foreign investors, tax incentives, business-friendly laws, and financial stability. Moreover, Singapore’s income tax rates for individuals range from 0% to 22% and the country does not impose capital gains tax, inheritance tax, or estate duty. Investors are also exempt from stamp duty when buying shares listed on the Singapore Stock Exchange, and dividends paid to investors are tax-free. Businesses in Singapore face a flat corporate income tax rate of 17%, along with various tax incentives and grants available for companies based there. Furthermore, Singapore boasts political stability and a safe, peaceful environment.

According to worldgovernmentbonds.com, Singapore’s debt rating from Standard & Poor's, Moody's Investors Service, Fitch Ratings, and DBRS is AAA, making it the only country in the Asia-Pacific region with this outstanding long-term credit rating. In terms of corruption, Transparency International’s 2022 report places Singapore at a score of 83, ranking it fifth globally, further reinforcing investor confidence in the region.

FDI by Source Country

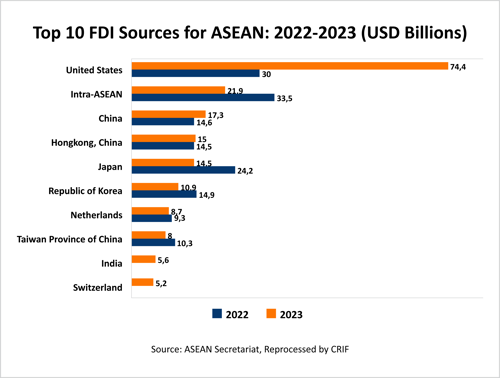

Eighty percent of FDI into ASEAN in 2023 came from the top 10 investor countries, up from 75% in 2022 (see Table 1.3), underscoring the importance of these investors in maintaining high FDI flows. The United States and China stand out as the leading investors in the region, with their FDI reaching record levels in ASEAN.

U.S. companies were the largest group of investors, with their FDI increasing more than twofold to USD 74 billion, accounting for one-third of the total FDI inflows to ASEAN. This investment is highly concentrated by country and industry, with over 90% flowing into Singapore, and around 70% directed toward the finance and insurance sectors, which have grown eightfold.

FDI from China rose nearly 20%, reaching USD 17 billion. More than 35% of this FDI went into manufacturing, followed by 20% each in wholesale and retail trade, and real estate—the traditional sectors for Chinese FDI.

India has re-entered the list of the top 10 FDI source countries for the second time since its debut in 2012. FDI from India doubled to USD 5.6 billion, with over 80% of it in financial activities. Meanwhile, FDI from other major sources, such as intra-ASEAN countries, Japan, South Korea, and the Netherlands, has seen a significant decline.

The majority of foreign direct investment in ASEAN still comes from countries outside the region, highlighting ASEAN’s importance in the global economy. In 2023, FDI from outside ASEAN grew by 6.3%, reaching USD 208 billion. The United States remains the largest investor, contributing USD 74.4 billion, or 32.4% of the total FDI in ASEAN. Intra-ASEAN trade is the second-largest source of investment, followed by China. Hong Kong and Japan also made significant investments.

Intra-ASEAN FDI

Although FDI from intra-ASEAN countries has been increasing over the last three years, it saw a decline of 34.7% in 2023, dropping from USD 33.5 billion in 2022 to USD 21.9 billion in 2023. Indonesia emerged as the largest recipient of intra-ASEAN FDI in 2023, receiving nearly 30% of the total intra-ASEAN FDI at USD 6.4 billion. Malaysia, Singapore, and Vietnam also attracted significant FDI, with USD 5 billion, USD 4.7 billion, and USD 4.2 billion, respectively.

In 2022 and 2023, companies from OECD countries committed over USD 55 billion to factories in ASEAN, more than double the amount they pledged to China. This shift began as companies sought to avoid U.S. tariffs on Chinese-made products and was accelerated by the COVID-19 pandemic, which made it more difficult for businesses to operate under China’s strict regulations.

Key Takeaways and Strategic Recommendations for ASEAN and Indonesia's Future Growth

Based on the data and analysis presented, CRIF Indonesia concludes that ASEAN holds immense potential to become a global economic growth hub. However, realizing this potential requires concerted efforts from all ASEAN member states, foreign investors, and international institutions. With the right policies and strong support, ASEAN can become an even more prosperous and competitive region.

Indonesia, in particular, holds great potential to attract more FDI, but improvements are needed in several areas, such as simplifying regulations, enhancing infrastructure, and strengthening the rule of law. To further capture the attention of major investors like the U.S. and China, Indonesia should focus on sectors of investment that align with each country’s interest: the U.S. is more focused on the financial sector, while China leans towards manufacturing and infrastructure.

The role of intra-ASEAN investment also remains crucial in driving regional economic growth, despite its decline in 2023. Another key takeaway is that Indonesia can learn from Singapore's best practices in attracting FDI. By creating a business-friendly environment, ensuring political stability, and upgrading infrastructure, Indonesia can foster greater investor confidence.

Additionally, governments in the region must create favorable policies to ease the process of business registration, improve regulatory frameworks, enhance infrastructure such as roads, ports, and airports, and ensure legal certainty and investor protection to boost investor trust and inflows.