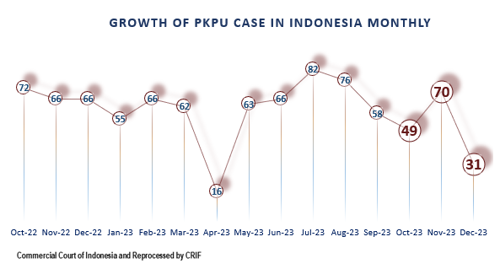

The case trend of postponement of debt payments (PKPU) in Indonesia in Q4/2023 is the main focus in the economic and legal panorama. As business dynamics continue to change, various challenges arise that not only affect debtors and creditors, but also create a significant impact on the national financial ecosystem. The Q4/2023 recorded a significant decrease in the number of PKPU cases.

In Q4/2023, a significant decrease of 31.6% was recorded in the number of postponement of debt payments (PKPU) cases in Indonesia, reaching 150 cases. This figure shows a quite striking decrease compared to the previous quarter, namely Q3, which recorded 216 PKPU cases. Meanwhile, on an annual basis, the number of PKPU cases has decreased by 26.5%. Factors that have contributed to the decline include economic policies, changes in market conditions, or prevention efforts carried out by related parties.

From the graph presented, it can be concluded that there have been variations in the number of postponement of debt payments (PKPU) cases in various regions over the last few quarters. Focusing on Q4/2023, even though there is a national decline, it should be noted that each region has a different pattern. Central Jakarta, for example, experienced a decline of 31.9% from the previous quarter, while Semarang showed stability by experiencing only a decrease of 1 case. Surabaya and Medan also recorded a decline, respectively by 9.4% and 6.3%, but Makassar actually experienced an increase of 175%.

The majority of PKPU cases, namely around 80.67%, show the need for resolution through the bankruptcy process and postponement of debt payments. This can be interpreted as a strategy to extend the time for debt repayment, provide space for financial restructuring, or avoid the risk of outright bankruptcy. On the other hand, 19.33% of cases filing bankruptcy declarations reflect significant economic pressures that encourage entities to seek legal protection

Based on PKPU case data for the last three months of Q4/2023, a quite significant fluctuations can be seen. Starting from October with 49 cases, the number decreased drastically in December to 31 cases. Even though there was an increase in November, reaching 70 cases, overall, there is a downward trend as 2023 ends. This phenomenon reflects the changing economic and financial dynamics in society as well as the response of business actors to these conditions.

In general, the decline in PKPU cases in December can be interpreted as a recovery effort or strategic adjustment made by companies and individuals to face fluctuating economic conditions at the end of the year.

Based on data on the number of PKPU cases in Q4/2023, the construction sector is the largest business line affected with a percentage of 12.00%, indicating that there are significant challenges in this industry. Related industries such as "Engineering, Procurement, and Construction (EPC)" and "Manufacture of Other Non-Metallic Mineral Products" also showed an impact with percentages of 1.33% and 4.00% respectively. Although other sectors have lower percentages, such as "Real Estate Activities" (11.33%) and "Wholesale Trade, except of motor vehicles and motorcycles" (4.67%), attention to specific trends or patterns in the case of PKPU in the industry- This industry remains important. Thus, companies in this sector need to carry out in-depth evaluations and take appropriate steps to overcome emerging problems and mitigate related risks.

The most highlighted PKPU cases in Q4/2023

From the table of the number of PKPU cases based on business lines above, it is revealed that the construction business line recorded the highest number of cases, namely 18 cases during the last three months of 2023. Several cases that received the main spotlight were related to the involvement of well-known construction companies in Indonesia. CRIF Indonesia has collected the following information:

1. There are 17 construction-related cases registered in the Central Jakarta SIPP and 1 case in Surabaya in Q4/2023.

2. Several state-owned companies (BUMN) or BUMN subsidiary entities that are defendants in this PKPU case include PT Indah Karya (Persero), PT Nindya Beton, PT Waskita Karya (Persero) Tbk, PT Hutama Karya (Persero), and PT Waskita Karya (Persero) Tbk.

3. These cases attracted public attention, especially because of the involvement of state-owned companies (BUMN), which not only occurred in the last quarter of 2023 but also since the previous quarter.

4. Several decisions in several PKPU cases in the construction business line ended with the status "revoked by the plaintiff," as explained in a previous article by CRIF Indonesia (https://visiglobal.co.id/cantingqind/the-trend-of-postponement-of-debt-payment-obligations-pkpu-cases-in-q3-2023/2023/11/). This shows that a number of state-owned companies that were defendants ultimately did not go through the legal process to be sued.

5. One of the similar cases that occurred in Q4/2023 is the case of PT Hutama Karya (Persero) with the following details:

|

Based on the Case Tracking Information System (SIPP) of the Central Jakarta District Court, it is known that PT Hutama Karya is being sued by four parties related to the Postponement of Debt Payment Obligations (PKPU), namely PT Sinar Mutiara EPC, PT Rekayasa Energi Bersama, PT Yuan Sejati, and PT Baloi 128, registered under case number 409/Pdt.Sus-PKPU/2023/PN Niaga Jkt.Pst on December 13, 2023. In their petition, there are six petitum submitted by the petitioner to the panel of judges handling the case: 1. Granting the request for Postponement of Debt Payment Obligations (PKPU) submitted by the PKPU Applicants against the PKPU Respondents in its entirety; 2. Declaring PKPU Respondent I (PT HUTAMA KARYA (Persero)) and PKPU Respondent II (PT TIMAS SUPLINDO) are under Temporary Postponement of Debt Payment Obligations (Temporary PKPU) for a maximum of 45 (forty-five) days from the pronouncement of the a quo decision; 3. Appointing a Supervisory Judge from Commercial Judges at the Commercial Court of the Central Jakarta District Court to oversee the PKPU process of the PKPU Respondents; 4. Appointing Mr. Febri Rachmatullah, S.H., as a Curator and Administrator registered at the Ministry of Law and Human Rights of the Republic of Indonesia under Letter of Registration of Curators and Administrators (SBPKP) Number AHU.124.AH.04.03-2020, residing at IKRA, Alamanda Tower 25th Floor, Jl. TB Simatupang Kav. 23-24, Jakarta 12430, Indonesia, as the Administrator in the process of Postponement of Debt Payment Obligations (PKPU) for the PKPU Respondents and subsequently as the Curator in the event the PKPU Respondents are declared bankrupt; 5. Ordering the Administrator of the PKPU Respondents to summon the PKPU Respondents and Creditors known by registered mail or courier, to appear in a hearing held no later than 45 (forty-five) days from the Temporary Postponement of Debt Payment Obligations (Temporary PKPU) decision a quo; 6. Stating that the amount of the Administrator's fee will be determined later after the Administrator has completed his duties; and Imposing all costs in this Petition on the PKPU Respondents. In the first hearing, the petitioners then withdrew their entire PKPU application against the respondents. This is in accordance with the verdict that granted the petition to withdraw the PKPU Request by the Attorneys of the PKPU Petitioners dated December 21, 2023. The panel of judges also declared the PKPU Request with Register Number 409/Pdt.Sus-PKPU/2023/PN Niaga Jkt Pst., withdrawn and ordered the Clerk of the Central Jakarta District Court to strike off the case of the PKPU Request from the relevant case register book. As of now, the final decision on the case is the withdrawal of the Request for Postponement of Debt Payment Obligations (PKPU) under case number 409/Pdt.Sus-PKPU/2023/PN Niaga Jkt.Pst. |

In concluding this discussion, analysis of PKPU cases in Q4/2023 highlights the complexity and attention attracted by the construction sector, especially involving well-known companies in Indonesia. By recording 18 cases, it is clear that challenges in the construction industry are not only tactical in nature, but also have an impact on the level of publicity and public attention. The involvement of state-owned companies (BUMN) in a large number of these cases is in the spotlight, raising questions regarding stability and governance in the sector. Interestingly, some of the final judgments in these construction cases were “withdrawn by the plaintiff,” suggesting that some of the state-owned companies that were defendants managed to avoid legal action. This means that it is important for related parties to understand these dynamics in more depth in order to formulate appropriate strategies for dealing with similar problems in the future. Overall, this situation provides a comprehensive picture of the legal and governance issues affecting the construction sector in this particular period.

The projection is that the number of PKPU and bankruptcy cases in 2024 will increase, not because Indonesia's financial condition is not good, but rather because funding sources are about to be reborn. The election will not affect the number of PKPU and bankruptcy cases next year because no business industry is prohibited from operating during the election.

Copyright © CRIF Indonesia. 2024

Disclaimer: This publication is provided for information purposes only and is not intended as investment advice, legal advice or as a recommendation as to particular transactions, investments or strategies to any reader. Readers must make their own independent decisions, commercial or otherwise, regarding the information provided. While we have made every attempt to ensure that the information contained in this publication has been obtained from reliable sources, CRIF Indonesia is not responsible for any errors or omissions, or for the results obtained from the use of this information. All information in this publication is provided ’as is’, with no guarantee of completeness, accuracy, timeliness or of the results obtained from its use, and without warranty of any kind, express or implied. In no event will CRIF Indonesia, its related partnerships or corporations, or the partners, agents or employees thereof, be liable to you or anyone else for any decision made or action taken in reliance on the information in this publication or for any loss of opportunity, loss of profit, loss of production, loss of business or indirect losses, special or similar damages of any kind, even if advised of the possibility of such losses or damages.