Indonesia’s livestock industry is entering an Inflection Point in the national development agenda. As food and agricultural priorities evolve, the sector is no longer viewed as merely supplementary as it is now seen as a key driver of food security, regional economic development, and export competitiveness. Under the latest policy direction from the Directorate General of Livestock and Animal Health (Ditjen PKH) and supported by 2024 data from Statistics Indonesia (BPS), the sector has shown consistent improvement and holds significant growth potential through at least 2027.

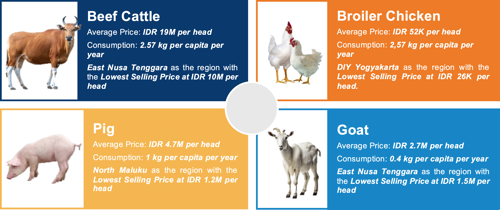

Recent 2025 data from the Ministry of Agriculture and BPS offers a comprehensive snapshot of the livestock commodity landscape, covering beef cattle, broiler chickens, pigs, and goats. Although beef and broiler chicken share the same per capita consumption rate at 2.57 kg/year, their market dynamics vary greatly. Beef commands a high average price of IDR 19 million per head, appealing to the premium market segment, whereas broiler chicken, priced at just IDR 52,000 per head, remains the most affordable and widely consumed protein source. Yogyakarta offers the lowest broiler prices at IDR 26,000 per head, making it an attractive region for large-scale poultry producers.

Pork consumption stands at around 1 kg per capita annually, with an average price of IDR 4.7 million per head. While nationwide demand remains limited due to religious and cultural factors, regional markets like North Maluku where pork prices can be as low as IDR 1.2 million per head remain highly relevant. Goat meat records the lowest per capita consumption at just 0.4 kg/year, with average prices around IDR 2.7 million per head. Demand is typically seasonal, peaking during religious holidays. East Nusa Tenggara stands out as a key production zone, offering the lowest prices for both beef cattle (IDR 10 million) and goats (IDR 1.5 million), making it a strategic area for supply chain development.

This data provides crucial insights for agribusiness investors, livestock producers, and market planners highlighting where pricing efficiency aligns with regional demand and revealing high-potential commodities for targeted growth and distribution.

Rising Prices Reflect Supply Pressures and New Opportunities

Livestock prices have been trending upward, signaling production-side pressures but also presenting income growth opportunities for farmers. Monthly fluctuations such as a 2.96 percent spike in beef prices in June and a 3.37 percent rise in broiler chicken prices in March underscore the active dynamics of supply and demand throughout the year. Seasonal trends, feed distribution, and market access remain key factors driving price volatility. Over the long term, price stability will depend largely on the efficiency of supply chains and the consistency of locally sourced animal feed.

Fiscal support has also been strengthened through the 2025 Budget Implementation Document (DIPA) of Ditjen PKH, which allocates IDR 1.213 trillion. This funding supports programs focused on enhancing food availability, access, and consumption quality, as well as improving industry management and competitiveness. The government has set 2025 production targets of 4.71 million tons of meat, 0.84 million tons of milk, and 6.89 million tons of eggs. Additionally, the Directorate aims to lower livestock mortality rates caused by disease, which currently range between 2% and 5% depending on the species.

Beyond production, upstream-to-downstream strategies are gaining momentum. The government is pushing for the digitalization of the livestock sector, including platforms for monitoring animal populations, smart feeding apps, and real-time disease reporting systems. These tools are designed to accelerate outbreak responses and enhance the accuracy of livestock data for policymaking. Pilot projects using IoT technology to monitor dairy cow health and milk quality are already underway in several provinces.

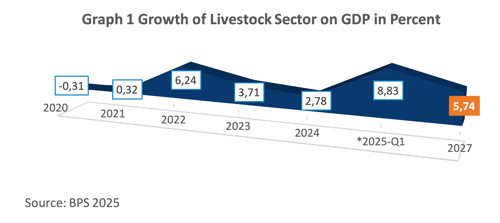

The livestock industry is projected to grow at an average annual rate around 5.74 percent through 2027. Recent data from Statistics Indonesia (BPS) shows that the Gross Domestic Product (GDP) growth rate of the livestock sub-sector has fluctuated over the past five years. In 2020, the sector contracted by -0.31 percent due to the impact of the pandemic. However, recovery began in 2021 with a growth of 0.32 percent, followed by a significant surge to 6.24 percent in 2022. Growth slowed to 3.71 percent in 2023 and further to 2.78 percent in 2024. Nevertheless, the first quarter of 2025 shows strong positive momentum with year-on-year growth reaching 8.83 percent, indicating a robust rebound and acceleration as the sector enters the second half of the decade.

This performance reflects both market dynamics and the influence of policy, which positions the livestock sub-sector as a key indicator in national agricultural and food market research. The upward trend is also supported by shifting urban consumer lifestyles that increasingly prioritize healthy, high-protein diets.

Strategic Growth Engine for Indonesia

The livestock industry holds vast potential to support national economic growth. Indonesia’s geographic advantages and tropical climate provide year-round opportunities for raising various types of livestock. Indigenous genetic resources such as Bali cattle, Java goats, and native chicken breeds are valuable assets that offer strong potential for further development. Moreover, the country’s demographic bonus, with most of the population in the productive age group, represents a promising labor force for this sector.

A large and steadily growing domestic demand also drives market expansion, supported by a population of over 270 million that requires a sustainable supply of animal-based protein. This demographic foundation fuels consistent consumption, making the domestic market a key engine for growth

Export opportunities are also highly promising, particularly in regions such as the Middle East, South Asia, and Africa. Products like hatching eggs, processed poultry, and veterinary pharmaceuticals made in Indonesia have already entered international markets and continue to grow. Furthermore, there is significant potential to develop integrated and modern livestock zones (smart livestock farming), supported by increased adoption of technology and green investment initiatives.

This positions the livestock industry as a strategic sector not only for food resilience and rural development but also for boosting export performance and attracting sustainable investments.

Challenges Still Facing the Industry

![]()

Despite its significant potential, Indonesia’s livestock industry continues to face a few structural and technical challenges. The dominance of small-scale, inefficient farming operations remains a major barrier to improving productivity and competitiveness. Limited access to financing, technology, and markets also poses difficulties for smallholder farmers. Moreover, the industry’s heavy reliance on imported raw materials such as corn and soybeans for animal feed makes it highly vulnerable to global price fluctuations.

![]() Other issues include weak farmer organizations, inadequate cold chain distribution infrastructure, and uneven availability of veterinary health services across regions. Climate change also presents serious challenges, particularly by disrupting livestock reproductive cycles, reducing the availability of forage, and triggering the emergence of new diseases that are difficult to detect and manage quickly.

Other issues include weak farmer organizations, inadequate cold chain distribution infrastructure, and uneven availability of veterinary health services across regions. Climate change also presents serious challenges, particularly by disrupting livestock reproductive cycles, reducing the availability of forage, and triggering the emergence of new diseases that are difficult to detect and manage quickly.

Government Response to Industry Challenges

In response to the various challenges facing the sector, the Indonesian government has introduced a range of strategic policies and programs. A key initiative is the corporatization of smallholder livestock farming, aimed at consolidating fragmented operations into more efficient and bankable entities. The government is also promoting the integration of livestock farming into corporately managed zones such as food estates and agropolitan areas.

In terms of financing, the government is expanding smallholder access to People’s Business Credit (KUR) specific to the livestock sector and strengthening livestock insurance schemes. On the technology front, various vocational training programs and smart farming initiatives have been launched in collaboration with universities, the private sector, and international organizations.

To address the dependency on imported feed ingredients, the Ministry of Agriculture, through the Directorate General of Livestock and Animal Health Services (Ditjen PKH), has initiated programs to diversify local feed sources and develop fermented feed from agricultural waste. This effort aims to reduce production costs while enhancing the long-term resilience of the livestock industry.

Through inter-ministerial coordination, fiscal policy support, and active private sector engagement, the government envisions that Indonesia’s livestock industry will not only achieve self-sufficiency in animal protein but also become a competitive export force in the Asian region in the coming years.

With a combination of strategic policies, improved producer prices, and more structured financing, Indonesia’s livestock industry is positioned to become a leading sector in modern and sustainable agricultural development. If reform momentum is sustained and supported by innovation and multi-sectoral partnerships, by 2027 Indonesia will not only be able to meet its domestic protein needs but also strengthen its position as a regional and global exporter of high-quality livestock products.