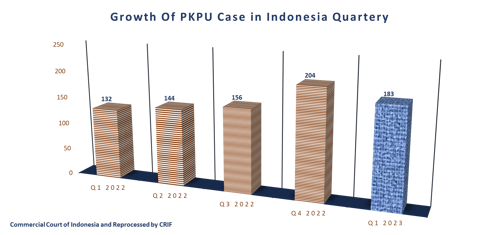

Based on the data we have collected, the number of cases of Postponement of Debt Payment Obligations (PKPU) in Q1/2023 decreased quarterly (QoQ) by 10.29%, but increased by 38.64% compared to Q1/2022 or on an annual basis (YoY).

Based on the data we have collected, the number of cases of Postponement of Debt Payment Obligations (PKPU) in Q1/2023 decreased quarterly (QoQ) by 10.29%, but increased by 38.64% compared to Q1/2022 or on an annual basis (YoY). This condition illustrates that the business world is still unstable in the midst of global economic conditions affected by geopolitical conflicts and so on.

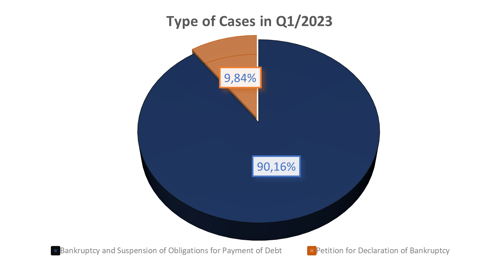

Based on the Case Search System (SIPP) update for Q1/2023, there were 183 cases registered with details of 165 cases of Bankruptcy and Postponement of Debt Payment Obligations and 18 cases of Petition for Declaration of Bankruptcy.

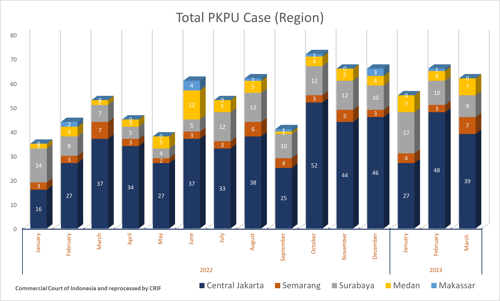

Based on the upsurge of PKPU cases in Q1/2023, the growth in the number of cases is above 50, namely in the range of 55-62 cases per month. For information, the average number of PKPU cases in the last 12 months is 57 cases per month. PKPU cases with the highest number occurred in October 2022 with a total of 72 cases and then in November 2022, December 2022 and February 2023 with a total of 66 cases.

Based on the data below, it can be seen that Central Jakarta contributes the largest number of cases each month with an average of 35 cases per month. The second position is occupied by Surabaya with an average of 10 cases per month and the next position is occupied by Medan with an average of 5 cases per month.

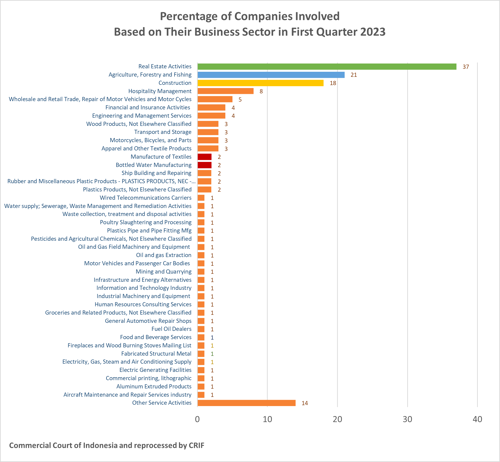

WHICH INDUSTRIES ARE THE MOST HEAVILY INVOLVED IN PKPU CASES IN Q1/2023?

After processing and analyzing data, most of the subjects involved in these cases came from the Real Estate Activities sector, namely there were 38 cases or (23.31% of the subjects involved), Manufacture 22 cases (13.50% of the subjects involved) , and Agriculture, Forestry, and Fishing 20 cases (12.27% of the subjects involved). This sector is the business sector where the largest number of PKPU cases occurred compared to other business sectors in Q1/2023.

For the manufacturing industry in Q1/2023 there were only 4 cases recorded. Based on the type, 2 cases were from the textiles sector and 2 cases were from bottled water manufacturing.

Property growth this year has just bounced back from pressures during the Covid-19 pandemic. A number of developers have begun to aggressively launch new property products. This is in line with the projected property sector in Indonesia which is expected to continue to grow in 2023 despite the challenges of global economic pressure. (Kontan, 2023)

As quoted from Bisnis.com, which was released on October 11, 2022, it is known that a number of property companies in Indonesia are bankrupt. The Indonesian Real Estate Companies Association (REI) said that the collapse of a number of property developers in Indonesia was not solely due to the Company's internal conditions. This bankruptcy is also caused by the legal system in Indonesia regarding the bankruptcy of a company which is very vulnerable and easy to change status. The Law on Bankruptcy in Indonesia is considered to make it very easy for companies to go bankrupt, with only two creditors it can bankrupt one company.

HOW THE US ECONOMIC THREAT PREDICTIONS EFFECT ON PKPU?

As of early February 2023, there has been an improvement in the world economy which has been in turmoil since 2022. The prices of various commodities have decreased due to expectations of a slowdown in the world economy, although they are still above before the pandemic. The next important global step is to normalize inflation, among other things, by increasing interest rates. Attention is focused on the United States because the US interest rate policy has the potential to affect capital flows and the US economy itself. Recent developments show inflation in the US can be controlled to 6.5% in December 2022 from 9.1% in June 2022. (Kompas, 2023)

Another caution that needs to be observed is the banking crisis that started last March. Precisely since the collapse of Silicon Valley Bank (SVB), followed by Bank Silvergate and Signature.

In early May, First Republic Bank was also hit by the same thing after its shares fell 50% last April. Rescue efforts were also carried out by being acquired by JPMorgan Chase & Co. The collapse of the banks here is inseparable from the high interest rates in Uncle Sam's country. US interest rates are currently in the range of 4.75% to 5%.

Interest rates were raised by the US central bank, the Federal Reserve (Fed) due to high inflation. One of the factors is the scarcity of goods and rising prices due to sanctions and the Russian-Ukrainian war.

Not only the banking crisis, most recently, the US had to face the fact that many bankruptcies hit companies in the country for four months in early 2023, the highest since 2010. The country is even now under threat of default, aka default. This was due to the parliament not agreeing to increase the ceiling on the federal government's debt limit, from USD 31.4 trillion. Discussions with the US House of Representatives, which has been controlled by the opposition Republican Party since January 3, are to blame.

Not to mention the fact that "throwing dollars" aka de-dollarization is also becoming a trend in many parts of the world. A number of facts show how the US was no longer used by China & Brazil, since March. Where the two agreed to no longer use US dollars and switch to using their own currencies, Yuan and Real.

On the other hand, India has also issued new policies to further increase the use of rupees in their trade since April 2023. One of them is with Malaysia and the United Arab Emirates (UAE).

Indonesia 's neighbors are also not left behind with the de - dollarization plan . This is through a local currency transaction (LCT). Indonesia, Thailand, Malaysia, Singapore and the Philippines have signed cooperation agreements for cross-border payment transactions. This is through QR codes, fast payments, data, and local currency transactions.

Therefore, the government and business players are expected to continue to observe and realize various developments, because the peak of global inflation can continue. The storm of financial crisis has not moved and is still hanging over BUMN (SOE) and its subsidiaries. In fact, this chaos led to a lawsuit for Suspension of Debt Payment Obligations (PKPU) in court.

The government is also advised to evaluate the assignment burden and the competitiveness of SOEs. And if the condition of SOE companies can still be recovered, the government needs to inject capital to support the performance of SOE companies.

Business players must also prepare for the possibility of unstable world economic performance and try to avoid bankruptcy lawsuits. Because the impact of bankruptcy litigation is very serious, it will destroy the reputation and image of business players.