The influence of global economic conditions affected by geopolitical conflicts and the pandemic has become a major challenge for the business world in Indonesia. However, the latest data released by the Case Search System (SIPP) in Q2/2023 shows an interesting change in the number of cases of Postponement of Debt Payment Obligations (PKPU).

The influence of global economic conditions affected by geopolitical conflicts and the pandemic has become a major challenge for the business world in Indonesia. However, the latest data released by the Case Search System (SIPP) in Q2/2023 shows an interesting change in the number of cases of Postponement of Debt Payment Obligations (PKPU).

Based on the collected data, the number of PKPU cases in Q2/2023 decreased by 20.77% when compared to the previous quarter (QoQ). This decrease does not necessarily indicate an improvement in the Company's financial condition. If you look at it in total, in the first half of 2022 there were 276 cases and in the first half of 2023 it increased by 328 cases. This increase indicates that the business world still has to face challenges in overcoming the impact of ongoing global instability. This change in the trend of PKPU cases also reflects the importance for companies to continue to monitor their financial condition carefully and proactively. Prudent financial management and adaptive business strategies will be the keys to dealing with economic uncertainties and potential risks that may arise in the future.

The latest data from the Case Search System (SIPP) for Q2/2023 shows that there are 145 cases registered, with details of 131 cases of Bankruptcy and Suspension of Obligations for Payment of Debt and 14 cases of Petition for Declaration of Bankruptcy.

Based on the development of PKPU cases in the last 12 months, there are around 16 to 72 PKPU cases per month. For the record, the average number of PKPU cases in the last 12 months has reached 57 cases per month. The highest number of PKPU cases was recorded in October 2022 with a total of 72 cases.

Based on the data above, it can be seen that Central Jakarta contributes the largest number of cases each month with an average of 36 cases per month. The second position is occupied by Surabaya with an average of 11 cases per month and the next position is occupied by Medan with an average of 5 cases per month..

THE CONDITIONS OF COMPANIES IN THE UNITED STATES IN Q2/2023

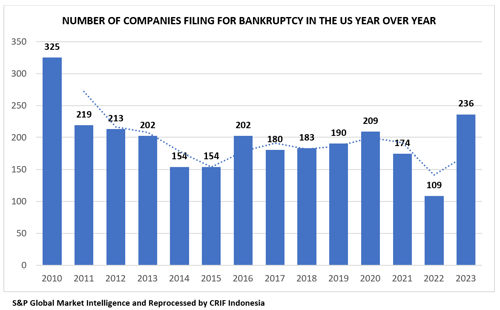

The United States (US) has so far escaped the economic recession. Even so, the economy of Uncle Sam's country cannot be said to be in good condition. Because companies filing for bankruptcy in 2023 are soaring, recording the highest record since 2010.

Previously, a Bloomberg survey said the probability of a recession in the US in 2023 would reach 65%. One of the highest after England, whose probability of being hit by a recession reaches 75%.

In fact, until Q1/2023 US economic growth was still positive at 1.1% year on year. The growth rate has indeed slowed compared to Q4/2022 which was 2.9%.

In the midst of positive economic growth, US companies filing for bankruptcy in 2023 are soaring. Bankruptcy which in the US is known as 'Chapter 11', does not always mean the Company is completely closed.

In 'Chapter 11', matters of bankruptcy or restructuring are also regulated, such as what is known in Indonesia as PKPU (Suspension of Obligations for Payment of Debt). This means that a company filing for bankruptcy can also request a credit/debt restructuring.

Quoted by S&P Global Market Intelligence, during January-April 2023 alone, a total of 236 companies have filed for bankruptcy. This number is the highest record since 2011. While in 2010, in the first four months there were 325 companies that filed for bankruptcy.

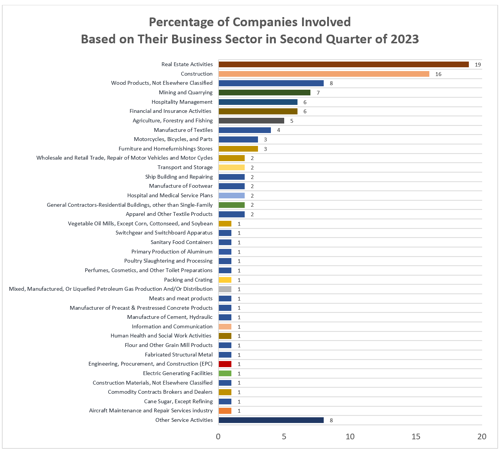

Still from S&P Global Market Intelligence, the business sector that filed for bankruptcy the most during January-April 2023 was retail companies. The most recent to file for bankruptcy on April 23, 2023, was retail company Bed Bath & Beyond Inc. The retailer of various furniture, interior and household appliances had previously closed all of their outlets in Canada.

One of the fundamental problems of the US economy today is high bank interest rates and inflation. This has put a lot of pressure on people's purchasing power. If these conditions do not improve, it is not impossible that the US will eventually enter a recession trap, namely when economic growth is negative for two consecutive quarters.

WHICH INDUSTRIES HAVE BEEN AFFECTED THE MOST IN PKPU CASE Q2/2023?

After processing and analyzing data, most of the subjects involved in these cases came from the Real Estate Activities sector, namely there were 19 cases or (16% of the subjects involved), Construction 16 cases (13% of the subjects involved), and Wood Products, Not Elsewhere Classified 8 cases (7% of the subjects involved). This sector is the business sector where the largest number of PKPU cases occurred compared to other business sectors in Q2/2023.

Property growth this year has just bounced back from pressures during the Covid-19 pandemic. A number of developers have begun to aggressively launch new property products. This is in line with the projected property sector in Indonesia which is expected to continue to grow in 2023 despite the challenges of global economic pressure. (Kontan, 2023)

Indonesia's Geopolitical Challenges Ahead of the 2024 Election and Potential Impacts on the PKPU Case in 2023

Facing the presidential and legislative elections in 2024, Indonesia's geopolitics is an interesting issue to explore in the context of the Postponement of Debt Payment Obligation (PKPU) case in 2023. Political tensions, economic instability, and policy changes that may occur ahead of elections can have an impact on the economy country and has the potential to affect the Company's financial condition.

The following are some interesting aspects that can be discussed related to Indonesia's geopolitical relations ahead of the 2024 elections with the PKPU case in 2023:

Political and Economic Uncertainty: in the period leading up to an election, there is usually high political uncertainty. This uncertainty can have an impact on economic stability, so companies are faced with challenges in planning and managing their finances. Companies can be more careful about taking risks and avoiding unnecessary debt, which has the potential to reduce PKPU cases.

Currency Exchange Rate Fluctuations: The period leading up to an election is often accompanied by currency exchange rate fluctuations due to market uncertainties. These fluctuations can affect companies that transact in foreign currencies or have debts in foreign currencies. Exchange rate volatility can put additional pressure on a company's liquidity and impact their ability to pay debts on time.

Political Policy Influence: Presidential and legislative elections can have an impact on the economic policies and regulations implemented by the government. Changes to this policy may affect the company's business conditions, liquidity and financial risks. The influence of this political policy can have an impact on company sustainability and the potential for PKPU cases.

Investment and Access to Capital: The increasing political tensions ahead of the election may affect investors' interest in investing in Indonesia. Investors may withdraw their capital from the market or withhold investment decisions until the political situation clears up. Decreased investment and limited access to capital can affect a company's ability to repay debts on time.

Security and Stability Factors: Controversial elections or political turmoil can have an impact on security and stability in a country. This instability can affect the company's operations and potentially cause a decrease in revenue. Disturbed security and stability can cause companies to face financial difficulties and PKPU risks.

In the face of geopolitical challenges ahead of the 2024 elections, companies must take prudent precautionary measures to mitigate PKPU risks. Effective risk management, market diversification, and adaptive financial strategies can help companies overcome uncertainty and maintain their financial stability amidst dynamic geopolitical conditions. In addition, transparency and collaboration with the authorities can help companies understand the impact of political policies and take appropriate steps to minimize the risk of PKPU cases in 2023.