After being hit by the pandemic for two years, various industrial sectors are showing signs of recovery. One of them is the construction industry, which is believed to have better performance in 2023. In 2023, the total construction market in Indonesia is estimated to reach IDR 332.95 trillion, which includes 47.29% in the civil sector and 52.71% in the building sector. (Investor.id, 2022).

Investment in infrastructure development will be the main focus of the Indonesian government. The Indonesian government has committed to increasing investment in the infrastructure sector and increasing the State Revenue and Expenditure Budget (RAPBN) specifically for this sector. The Indonesian government has prepared funds for infrastructure in the RAPBN for the fiscal year 2023, which is higher than in 2022. Allocation for infrastructure has increased by 7.75% from IDR 363.8 trillion in 2022 to IDR 392 trillion in 2023. (Kompas, 2022)

Business Players in Construction Sector Every Year

As a reference, the total number of companies engaged in the construction industry each year can be used to see the market and level of competition among business players each year. As seen in the graph below, in 2020 there was a decrease in the total number of construction companies in Indonesia by 5.66% compared to 2019. This was caused by the national economic downturn in the midst of the Covid-19 pandemic, which caused many companies to close down, not only in the construction sector, but also in various business sectors in Indonesia.

Based on data from Statistics Indonesia (BPS), the number of construction companies in Indonesia was 197,030 in 2022. This figure is down 3.13% compared to 203,403 units in 2021. The decrease in the number of construction companies is due to many infrastructure projects not being able to operate optimally, which is partly due to the negative impact of the Covid-19 pandemic. Additionally, the construction sector is also affected by the Russia-Ukraine conflict in 2022.

According to information from the Ministry of Public Works and Housing (PUPR), this ministry received a special assignment from the President through Presidential Regulation (Perpres) Number 120 of 2022 regarding Special Assignments in the Acceleration of Infrastructure Development Implementation. Specifically, the budget for 2023 will be allocated to complete ongoing construction projects, meaning there will be minimal new construction contracts in 2023.

Through this regulation, the Ministry of PUPR has been assigned 21 tasks to rehabilitate infrastructure in the water resources, civil works, highways, and housing sectors. Although new contracts in 2023 are expected to be minimal, Minister Basuki is optimistic that the construction industry can still grow positively in 2023.

The Ministry of PUPR, through the Directorate General of Public Works and Housing Infrastructure Financing (DJPI), is continuously trying to expand cooperation in infrastructure financing through the role of business entities under the Government and Business Entity Cooperation scheme (KPBU).

Sustainable infrastructure development financing innovations need to be implemented to overcome the limitations of the state budget in infrastructure development financing. The Director General of Infrastructure Financing said that in the 2022 budget year, the DJPI worked on 27 KPBU projects worth IDR 269.78 trillion in the Preparation Phase and 7 KPBU projects worth IDR 68.96 trillion in the Transaction Phase. In the 2023 budget year, the Ministry of PUPR, through the DJPI, targets 14 KPBU projects worth IDR 73.93 trillion in the Preparation Phase and 17 KPBU projects worth IDR 138.41 trillion in the Transaction Phase. (Open Data PUPR, 2022)

CRIF predicts that as the performance of the construction sector grows and is driven by an increase in national economic growth in 2023, the number of businesses in this sector will also increase. This condition is also in line with the increasing number of construction projects and infrastructure development in Indonesia, which is indicated to cause an increase in construction service providers in Indonesia.

The improving pandemic situation in 2022 has had a positive impact on the economic recovery in Indonesia and various business sectors, including the construction sector. According to the Indonesian Economic Growth Report 2022 released by the Statistics Indonesia (BPS), the construction sector experienced a growth of 2.01% throughout 2022. In 2023, CRIF projects a slight increase in the growth of the construction sector, at around 2.52% year on year. This condition is influenced by the increasing number of infrastructure projects that were previously hindered by the Covid-19 pandemic in the past three years. Therefore, the construction sector is predicted to continue to receive new construction projects from both the government and the private sector.

Infrastructure & transportation projects have increased sharply since 2021 as infrastructure investment emerges. The company's development projects will continue to be a key driver and support further growth. The Ministry of Investment or the Investment Coordinating Board (BKPM) noted that domestic investment (PMDN) realization in Indonesia reached IDR 552.8 trillion in 2022. The construction sector received PMDN realization of IDR 33.84 trillion. In total, throughout 2022 there were 197,875 investment projects from within the country. The trade and repair sector has the highest number of PMDN projects, namely 78,386 projects, followed by the construction sector with 24,381 projects.

The Investment Coordinating Board (BKPM), reprocessed by CRIF

Priority policies for 2023 are focused on accelerating infrastructure provision and selected national strategic projects that have entered the construction phase must be completed in semester I-2024. The 2023 and 2024 will be years of accelerated completion of toll road construction in various regions to improve connectivity between regions and the community's economy. The government will also allocate a significant budget for new infrastructure development projects throughout the region, including dams, ports and transportation facilities.

Challenges and Obstacles in the Construction Sector in 2023

Construction sector business players in Indonesia are predicted to face several challenges in 2023. Some of these challenges include:

Increase in Raw Material Costs

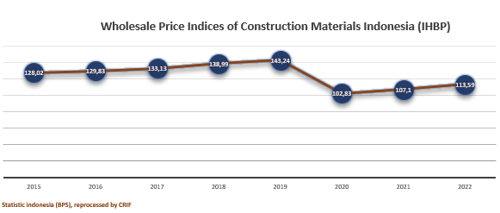

Increases in the price of raw materials such as cement, concrete iron, and wood can affect construction costs and make projects more expensive. Based on data from BPS, the increase in the Wholesale Price Index (IHPB) for the building or construction group increased by 6.06% in 2022 compared to 2021. Based on these data it is known that all groups of building types experienced an increase in 2022 compared to 2021.

Meanwhile, the commodity that experienced price increases from year to year was diesel fuel by 37.80% which contributed to wholesale price inflation of 1.83%. On the other hand, cement increased 8.52% and contributed to inflation by 1.16%, asphalt rose 15.37% and contributed 1.03%. Meanwhile, commodities that experienced a decline, namely concrete iron, fell 3.85% and contributed 0.48%, and steel roof trusses fell 6.30% and contributed 0.15%. (Bisnis.com, 2023)

Political Uncertainty

The government realizes that 2023 will be a year full of challenges, because the 2024 Political Year is approaching. This political condition is expected to affect the certainty of investment and construction projects.

Market competition

The more companies involved in the construction sector, the tighter the competition in obtaining projects.

Increase in Interest Rates

Interest rates in 2023 are predicted to be higher than in 2022. The impact of the interest rate hike on the construction sector in 2023 is the potential to reduce public interest in buying property, which will affect the business performance of construction companies and property sub-sectors. The increase in the Bank Indonesia (BI) interest rate in October 2022 has affected mortgage interest rates, which may decrease public interest in purchasing property in the future. This poses a challenge for construction and property companies to maintain their business performance amid a difficult market condition.

Therefore, business players in the construction sector are required to improve project efficiency and quality, optimize the use of human resources, and monitor changing regulations and market conditions. Although there is a threat of global economic recession triggered by inflation, Indonesia's economic foundation is considered relatively strong after passing through the pandemic period, providing promising construction business opportunities. This is driven by the government's commitment to continue large-scale infrastructure development and encourage the establishment of industrial facilities for raw material management.

In addition, new industrial zones with significant incentives attract foreign investors and accelerate industrial projects. Therefore, the Indonesian government continues to focus on strategic infrastructure projects and is motivated to accelerate the development of basic infrastructure and main buildings in IKN Nusantara (The National Capital of Nusantara).