In the current era of digital development, the online trading or e-commerce business in Indonesia is increasingly developing and is quite tight amidst global economic uncertainty. Several marketplaces, both in Indonesia and globally, had to lay off some of their employees because of these changes. On the other hand, the online business market in Indonesia will continue to grow seeing that interest continues to increase. Based on this, the distribution of labor will decrease due to efficiency from the use of high technology, but opportunities to open businesses online continue to increase. So, it gives the Indonesian people a great opportunity to open up their business opportunities by taking advantage of this trend.

Global Electronics Growth

Global "Electronics Market" Research companies are increasingly using cutting-edge research technologies, such eye-tracking technology, to gather customer insights. Businesses that offer marketing research and analysis services are increasingly putting an emphasis on the emotional bond that consumers have with products. Neuro marketing technologies like emotion assessment, eye tracking, and other implicit priming experiments are being used by Electronics market researchers to collect and assess data on consumers and unconscious brain responses. Without bias or errors, eye-tracking technology is excellent for gauging consumer reactions to products.

The most recent analysis on the Electronics Market comprises a detailed examination of business strategies pursued by up-and-coming industry players, market segments, the geographical scope, product scenes, and cost structures.

The global Electronics market size was valued at USD 1497415.58 million in 2022 and is expected to expand at a CAGR of 5.5% during the forecast period, reaching USD 2065063.0 million by 2028. Consumer Electronics have become an essential part of consumers’ daily life routines in the past decade. From conventional consumer electronic products such as smartphones, computers, laptops, digital cameras, DVDs, tablets, and printers, to advanced products such as camcorders, phablets, smart televisions, and wearable electronic devices, consumer electronics encompasses a wide product catalog. The report combines extensive quantitative analysis and exhaustive qualitative analysis, ranges from a macro-overview of the total market size, industry chain, and market dynamics to micro details of segment markets by type, application, and region, and, as a result, provides a holistic view of, as well as a deep insight into the Electronics market covering all its essential aspects. For the competitive landscape, the report also introduces players in the industry from the perspective of the market share, concentration ratio, etc., and describes the leading companies in detail, with which the readers can get a better idea of their competitors and acquire an in-depth understanding of the competitive situation. Further, mergers & acquisitions, emerging market trends, the impact of COVID-19, and regional conflicts will all be considered. In a nutshell, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the market in any manner. (Source: Industry Research Biz)

National Electronics Growth by GDP

Electronic products have a big role in supporting this development, especially for small electronics such as smartphones, gadgets, cameras, gadgets, and others. It is estimated that electronic products will still have high demand in the next few years, especially for small electronic products, smart cities, and high-tech home appliances that support the development of digitalization.

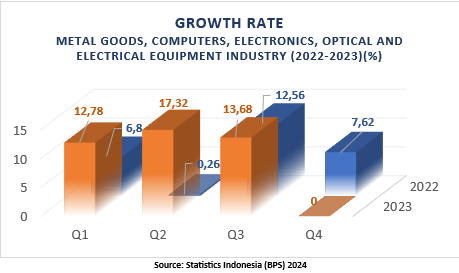

In Q3/2023, the growth rate of the metal goods, computer, electronics, optics, and electrical equipment industrial sectors experienced growth reaching 13.68% (y-o-y) or an increase of 1.12 points from growth in the same period in the previous year.

National Electronics Growth Prediction based on GDP in 2024

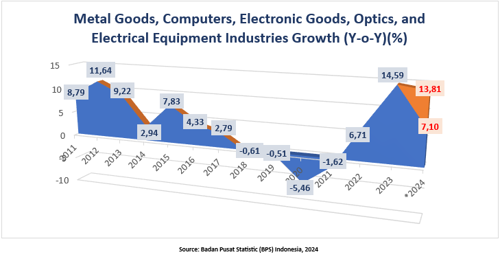

Based on data from Statistics Indonesia, growth in the metal goods, computer, electronics, optics, and electrical equipment industrial sectors in 2023 experienced growth of up to 14.59% (y-o-y). This growth was dominated by the increase in the electronics industry. The Ministry of Industry (Kemenperin) assesses that the electronics industry is one of the sectors that has priority development by the "Making Indonesia 4.0" road map. This is because the electronics industry is able to continue to make a significant contribution to the national economy in the next few years.

Apart from that, looking at developments in the last few years, this sector is predicted to still experience growth of around 7.10% (y-o-y) in 2024. If conditions are very good, the growth is even predicted to reach 13.81% (y-o-y). This prediction is based on the fact that business digitalization, especially e-commerce, is continuing to grow. So public and business interest in electronic products that support the implementation of e-commerce activities is still high.

To achieve this growth value, the Ministry of Industry encourages the electronics industry to continue to increase the level of domestic content (TKDN), quality, and competitiveness at the global level. To increase the productivity of the electronics industry.

Development of Home Electronics Sales in 2023

According to data from the Admitad affiliate network, in 2023 purchases of home electronic products by Indonesians increased by 5% (y-o-y) and spending increased by 4% (y-o-y) more. Although this growth is slightly behind global online sales growth of 9% (y-o-y), this still shows a positive trend in the electronics industry.

The global inflation crisis and rising production costs have affected the electronics industry, but several factors are helping the growth of the online electronics industry in Indonesia. Several positive factors have enabled online sales in the electronics industry to exceed the industry's headline growth rate, which global experts say is around 4-6% (y-o-y) by 2023.

Despite global orders showing an increase of 9% (y-o-y), spending on electronics in Indonesia increased 5% (y-o-y) in 2023. Consumers appear to prefer more affordable brands or decide to repair their devices rather than buy new ones. Despite this, Admitad remains optimistic about the growth of online sales in the electronics industry in 2023 and estimates that the Indonesian market will continue to grow steadily.

Electronic Development of Information and Communication Technology in 2023

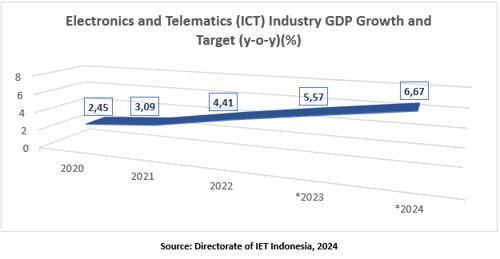

Moving positively with home electronic products, Information and Communication Technology (ICT) electronic products experienced growth of 5.57% (y-o-y) and are predicted to increase again to 6.67% (y-o-y) in 2024.

This increase was caused by the increasing role of products in the development of the digital industry in Indonesia, especially for telephone sets and smartphone products.

In the industry, telephone sets and smartphone products have the highest growth when compared to other products. Then followed by television or monitor electronic products and printing electronic products.

Based on the International Data Corporation (IDC) report, the smartphone market in Indonesia is experiencing an increase again. It was recorded that total national smartphone sales reached 8.9 million units throughout the third quarter of 2023 or grew by 8.8% (y-o-y).

Domestic smartphone growth last quarter was seen across all price segments, mainly led by higher-priced smartphones above USD 600, the Apple 15 Flip and Apple 16 Flip. Then below that is the middle-class segment with prices ranging from USD 200 to USD 600 which also grew by 16.8% (y-o-y), driven by Samsung, Apple, and Oppo as vendors strengthened their portfolios in this segment. In addition, the low-end segment with prices below USD 200 grew 2.7% (y-o-y) after experiencing a decline for several quarters due to intense competition between Transsion, Vivo, Xiaomi, and Realme.

Vendors focusing on more profitable higher price segments pushed average selling prices (ASP) to the eighth consecutive quarter of growth, with an increase of 9% (y-o-y) in the third quarter of 2023 to USD 205. In addition, it was seen that recovery of smartphone growth in Indonesia in the third quarter of 2023. On the other hand, vendors are expected to remain careful in developing their strategies to prevent overstock of their products. Because we see reports that national smartphone growth is still experiencing a slowdown.