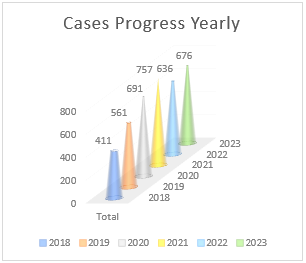

The cases of Suspension of Debt Payment Obligations (PKPU) involving business entities in Indonesia have once again come under scrutiny, whether related to cases from listed companies (emiten) or non-listed ones. After experiencing a decline in cases in 2022 (↓15.98%), PKPU cases have risen again by ↑6.29%, totaling 676 PKPU cases in the year 2023.

The government has expressed concern over this matter as a crucial response, which is also related to the World Bank's Ease of Doing Business (EoDB) report in 2020. In the latest report released in 2020, Indonesia's ranking in the discussion of resolving insolvency is positioned at 38th globally. When compared to fellow Southeast Asian countries, Indonesia ranks below Thailand at 24th and Singapore at 27th in the resolution of insolvency.

According to the Managing Partner of Dwinanto Strategic Legal Consultant (DSLC), this situation is attributed to a shift in the purpose of Law No. 37/2004 concerning Bankruptcy and Suspension of Debt Payment Obligations (PKPU), which is intended as a means for fair, fast, transparent, and effective debt resolution. The presence of Law No. 37/2004 should ideally be aimed at protecting debtors facing difficulties in business. If a debtor is genuinely struggling in business and debt repayment, they can use the bankruptcy filing mechanism, with a focus on debtor protection. However, at present, Law No. 37/2004 is being used as a tool or legal scheme for creditors to pursue debt collection from debtors. Consequently, the number of PKPU and bankruptcy filings in Indonesia is increasing, with the majority originating from creditors. Regardless of the existence of this law, it cannot be denied that the economic conditions of several business entities are currently not favorable. (Source: CNNIndonesia)

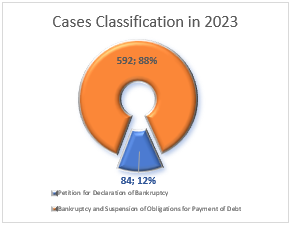

Out of the total 676 recorded cases of Suspension of Debt Payment Obligations (PKPU), 88% are categorized as "Bankruptcy and Suspension of Debt Payment Obligations," while the remaining 12% are classified as "Petition for Declaration of Bankruptcy."

In comparison to the previous year, there has been an increase in cases categorized as "Bankruptcy and Suspension of Debt Payment Obligation," rising from 540 to 592 cases. On the other hand, cases categorized as "Petition for Declaration of Bankruptcy" decreased from 96 to 84 cases.

The increase in these cases is attributed to the domino effect of the economic conditions during the COVID-19 pandemic that lasted for approximately three years. Businesses' production during the pandemic was suboptimal, yet they remained obligated to provide salaries to employees and cover other operational costs that exceeded their income. This led to insufficiency among businesses in meeting their other financial obligations. Indeed, businesses managed to survive during the pandemic until the government officially lifted the pandemic status in June 2023. However, the instability caused a backlog of deferred payments, becoming one of the factors contributing to the rise in PKPU cases in 2023.

These factors could be a result of a decline in businesses' competitiveness due to reduced purchasing power within the society. Additionally, it may be attributed to the businesses' economic management that has not fully promoted sustainability.

The Sectors Most Vulnerable to Involvement in PKPU and Bankruptcy Cases

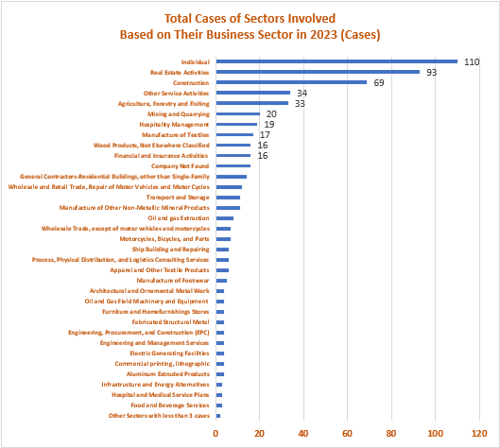

Based on the case records in 2023, the sectors with the highest number of PKPU and Bankruptcy cases are Real Estate, Construction, Services Activities, and Agriculture, Forestry, and Fishing. These four sectors are noted to have the highest involvement compared to others, with Real Estate having 93 registered cases, Construction with 69 cases, Services Activities with 34 cases, and Agriculture, Forestry, and Fishing with 33 cases.

In 2023, individual or personal cases still constitute the majority, totaling 16.27% of the overall cases. Furthermore, 33.88% represent cases from the four sectors with the highest incidences. The remaining 49.85% constitute cases from other sectors, each contributing less than or equal to 2.96% of the total cases during the year 2023.

An example of a case originating from the Agriculture, Forestry, and Fishing sector is PT CJ Feed and Care Indonesia, acting as the debtor, filing a PKPU petition to several creditors seeking a deferment of obligations, with the court ruling in favor of the request. The company's financial condition did not improve, leading to difficulties in meeting its responsibilities. This is evident through the company's implemented program in 2023. The company had to reluctantly execute cost-cutting measures by implementing a layoff program and offering a mass resignation program. In July 2023, a total of 41 employees were recorded as being laid off. This is a substantial number, especially considering the company is not labor-intensive. Moreover, the company has been in operation for around 25 years, and this is the first time such a program has been implemented.

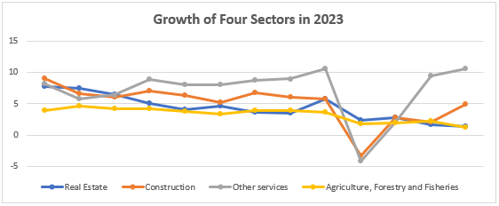

The prevalence of individual or personal cases is considered reasonable when viewed in light of the differences in population numbers. However, regarding sectoral development, economically, out of the four sectors with the highest cases, only one sector has experienced a decline in growth, namely Agriculture, Forestry, and Fishing. Hence, it can be said that the involvement of business entities in PKPU cases is indicative of the sector's economic downturn. Meanwhile, for the other three, it is suggested that the businesses are facing financial difficulties, or there may be other factors contributing to delays in meeting their responsibilities.

Based on the explanation, PKPU cases emerging in 2024 are still attributed to business entities that have not yet reached a point of being able to settle their bills, despite experiencing business improvements after the impact of COVID-19. This aligns with the predicted rebound in funding sources. The key point is that if the financial records of these business entities show positive results, it can be concluded that the larger their earnings, the quicker these businesses can break free from the constraints of PKPU cases. The ability of business entities to withstand and adapt will be severely tested.

Indeed, the increasing cases of PKPU and bankruptcy serve as a warning signal for the current and future economic conditions. However, Indonesia remains trapped with economic growth at the 5% level. Over the past nine years, the average economic growth in Indonesia has only reached the 4% level. While data from the Financial Services Authority (OJK) indicates that non-performing loans (NPL) in the corporate credit segment are still manageable, the trend in corporate credit disbursement is declining. Moreover, in certain sectors, the value of bad loans is on the rise. For example, as of October 2023, the NPL in the construction sector reached IDR 15.21 trillion, higher than the September 2023 figure of IDR 14.13 trillion.

The latest Bank Indonesia (BI) survey related to the demand and supply of banking financing mentions that corporate financing originating from new credit applications to domestic banks has experienced a decline. This is reflected in the Net Weighted Balance (SBT) concerning the addition of loans to banks, which stood at 12.7% in October 2023. In the previous month, the SBT was at 18.9%.

Chairman of the Advisory Board of the Association of Curators and Administrators of Indonesia (AKPI), Jamaslin James Purba, mentioned that the increase in PKPU cases during 2023 compared to the previous year is attributed to several factors. One of them is that individuals seeking justice and the legal community are increasingly understanding that the resolution of debt-related cases can be expedited in commercial courts. "The Bankruptcy and PKPU Law has stipulated a timeframe for the speedy resolution of cases," he stated. The PKPU status also allows debtors to reorganize their business by developing a restructuring program. (Source: Kontan)