The agricultural sector has an important role in the Indonesian economy, as evidenced by its contribution of around 12.40% to Gross Domestic Product (GDP) in 2022. As a leading subsector, plantations contribute 3.76% to total GDP and 30.32 percent to the agricultural sector, Forestry, and Fisheries. Palm oil, as the main commodity in plantations, has a strategic role in supporting industrial vegetable oil needs. As the largest producer in the world, Indonesia has great potential to market palm oil and palm kernel, both domestically and on the international market.

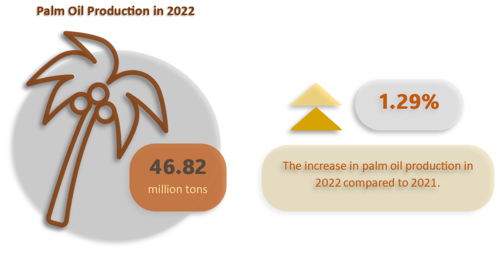

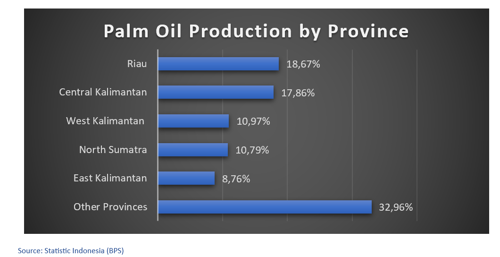

Based on data presented by Statistics Indonesia (BPS), it was revealed that palm oil production in Indonesia will increase by 1.29% in 2022, reaching a total of 46.82 million tonnes. The provinces of Riau, Central Kalimantan, West Kalimantan, North Sumatra and East Kalimantan are the main production locations, contributing significantly to this increase. The proportion of contributions from each region can be seen in the illustration provided.

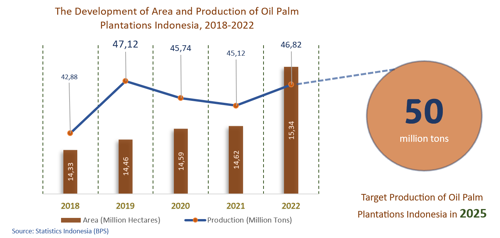

On the other hand, based on data presented by BPS, land use for Crude Palm Oil (CPO) production in Indonesia from 2018 to 2022 had increased significantly. Although the area of oil palm plantations has increased consistently, this growth is not in line with palm oil production during the same period. The increase in the area of oil palm plantations was caused by an increase in the administrative coverage of palm oil companies, so that the total area of oil palm plantations increased from 14.33 million hectares in 2018 to 15.34 million hectares in 2022.

However, fluctuations in CPO production in Indonesia are estimated to be influenced by the impact of the Covid-19 pandemic since early 2020, which has caused a decline in production. In 2021, there was a decrease of 1.36% compared to 2020, reaching 45.12 million tonnes. However, in 2022, CPO production increased again to 46.82 million tons. Riau Province is estimated to be the largest contributor to CPO production in 2022 with a total of 8.74 million tons, or around 18.67% of Indonesia's total production. Furthermore, Central Kalimantan Province is also a significant contributor with production of 8.36 million tons, covering 17.86% of total production.

THE TRAIL OF PALM OIL EXPORTS IN THE LAST FEW YEARS

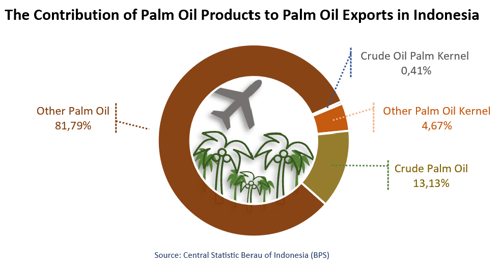

Based on the HS (Harmonized System) palm oil group, the largest export comes from the Other Palm Oil category (HS 15119000) which reached 81.79% of Indonesia's total palm oil exports in 2022. HS Code 15119000 is included in the product category refined, bleached, deodorized (RBD), and the like. Even in a more advanced context, this HS Code processed product is still in the same category as CPO, namely HS Code 15, which means that the processing carried out has not changed either the physical form or the added value.

Furthermore, the largest export contribution comes from Crude Palm Oil (HS 15111000), Other Palm Oil Kernel (HS 15132900), and Crude Oil of Palm Kernel (HS 15132110), each contributing around 13.13%, 4.67%, and 0.41% of total exports.

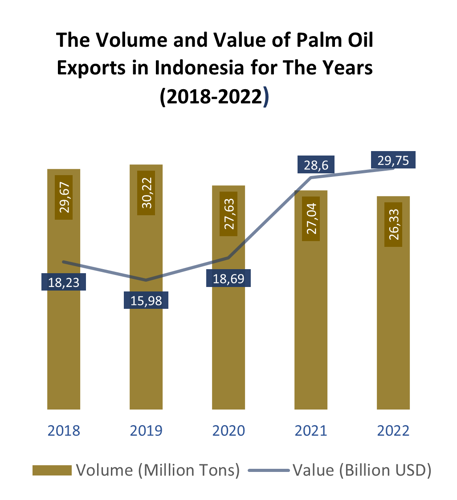

From a volume perspective, palm oil exports from 2018 to 2019 experienced an increasing trend. However, from 2020 to 2022, the volume of palm oil exports shows a decline. The largest decline in export volume occurred in 2020, with total exports of 27.63 million tons, a decrease of around 8.55 percent compared to 2019.

Although there has been a decline in the volume of palm oil exports, this trend is not in line with the increase in export value. According to data from the World Bank Commodities Price Data, although the price of palm oil fell in 2018 and 2019, reaching 639 USD/mt and 601 USD/mt respectively, it experienced a spike again in 2020 to 752 USD/mt. This resulted in an increase in export value of 16.94% compared to 2019. In 2021-2022, the increase in palm oil prices caused a significant jump in export value, reaching 29.75 billion USD in 2022.

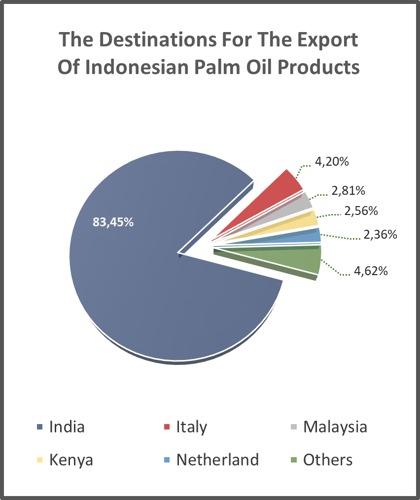

Most of Indonesia's palm oil production is directed to international markets, covering five continents, namely Asia, Africa, Australia, America and Europe, with the main share in Asia. In 2022, the top five countries as the largest importers of Indonesian Crude Palm Oil (CPO) were India, Italy, Malaysia, Kenya and the Netherlands. The combination of exports to these five countries reached 95.38% of Indonesia's total CPO exports. India is the largest export destination with a volume reaching 2.88 million tonnes or 83.45% of Indonesia's total CPO export volume, with a value of USD 2.85 billion. Furthermore, Italy and Malaysia are also the main export destinations, each contributing 4.20% and 2.81% of Indonesia's total CPO exports.

PALM OIL MARKET PREDICTIONS IN THE FUTURE

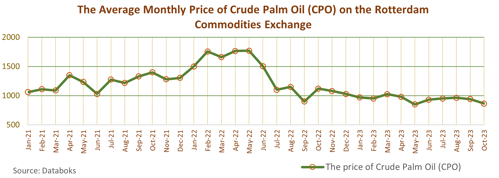

From 2021 to October 2023, it can be seen that the price of crude palm oil (CPO) has decreased significantly. Based on data from investing.com, the average CPO price on the Rotterdam commodity exchange in October 2023 reached USD 865 per ton. This figure shows a decrease of 7.98% compared to the previous month and decreased significantly by 22.77% compared to the same period in the previous year. These price movements reflect global market dynamics affecting the palm oil sector, with certain factors playing a role in these price fluctuations.

This price decline was influenced by seasonal increases in production in major producing countries as well as weak global import demand. The Food and Agriculture Organization (FAO) stated that international palm oil prices continued to decline in October due to these factors.

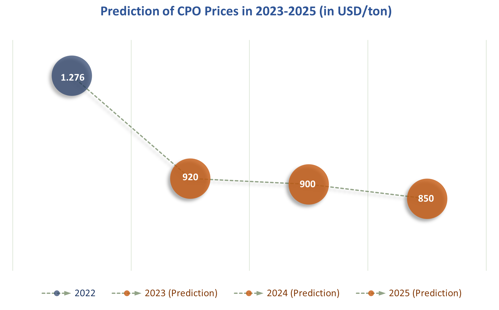

According to World Bank projections in the October 2023 edition of Commodity Markets Outlook, the average price of palm oil throughout 2023 is estimated to reach USD 980 per ton, 28% lower than in 2022. The World Bank also projects a decline in palm oil prices of 2% in 2024 and 6 % by 2025. Although global demand for palm oil is predicted to decline, the World Bank estimates that consumption of palm oil for biodiesel will increase in Indonesia and Malaysia. Indonesia increased its biodiesel mandate from 30% to 35%, while Malaysia had a mandate of 20%.

In the context of industrial optimism, Indonesian palm oil entrepreneurs, as expressed by the General Chairman of the Indonesian Palm Oil Entrepreneurs Association (Gapki), look to the future with confidence. Even though CPO (Crude Palm Oil) prices will experience challenges in 2023, factors such as the impact of El Nino on production in 2024 are expected to be a driver for price increases in 2024. Overall, CRIF Indonesia assesses that palm oil market conditions are influenced by production factors, global demand, and biodiesel policies in major producing countries. CPO prices may continue to fluctuate, and developments need to be monitored for better understanding in decision making in this industry.

THE DOWNSTREAMING OF PALM OIL BUSINESS IN INDONESIA

Downstreaming in the definition is an effort towards further or deeper or downstream processing of a commodity or product to achieve higher added value on an ongoing basis. Downstreaming is related to the concept of industrialization, namely steps to develop industries that process or manufacture (manufacturing) raw or primary raw materials into processed products or both secondary industries and finished products (final products) or tertiary industries.

The concept of downstreaming can be understood more easily using the harmonized system code (HS Code) trade classification. In this HS Code, the higher the initial value of the code, it can be interpreted as being more advanced or in processing or the product. If this classification is used for palm oil, for example, level 1 for the product is HS Code 14 for palm kernel and 15 for oil from both fruit and palm kernel.

The palm fruit and kernel are then further processed into level 2 products such as fatty acids, olein, stearin, glycerol, and others. These level 2 products are then processed or manufactured again into level 3 products, for example fatty alcohol, soap chips, industrial fatty acids, biodiesel, and others. Furthermore, both level 2 and level products are manufactured into final products such as margarine, soap, cosmetics, B30, and others. There are hundreds of types of commodities and processed products from palm oil, but only dozens have economic value and can be produced and exported according to the Statistics Indonesia (BPS). The products mentioned above are palm oil products based on the main HS Code only. All downstream palm oil products are used to supply either directly or substitute for imported raw materials for the domestic manufacturing industry, which is made from palm oil. Apart from that, it is also for export.

Policies in implementing the palm oil downstream strategy can be classified as promotion facilitation policies and protection barrier policies. The export promotion policy consists of a policy of reducing income tax for downstream industries and taxes for pioneer palm oil industries, combined with exemption from import duties on imports of machinery and goods and materials for industrial development, as well as the development of downstream integrated industrial areas for palm oil.

The final policy is the export levy policy by the Palm Oil Fund Management Agency which is used for the development of the downstream palm oil industry, biodiesel subsidies and palm product innovation research, while the main protection barrier policy is the policy of imposing export duties on palm oil and its derivatives to guarantee and increase the availability of materials. CPO raw material for domestic downstream industries. Then, the policy of mandatory provision of CPO for domestic biodiesel raw materials.

The impact of these various policies is statically quite good as illustrated above, namely the share of biodiesel exports and domestic biodiesel production by Pertamina which is getting higher. The share and value of processed palm oil products, both secondary and tertiary, are relatively significant and high when compared to CPO exports, and there is a wide variety of processed products that can be produced and exported. Policies that have not yet been touched upon include developing and strengthening the domestic industry and developing markets both domestically and globally, including market diversification for palm kernel-based production. Palm kernel is still exported raw or simply processed.

The two other policies above can be expected to further encourage the downstream palm oil industry to be controlled by national actors and the total added value of downstream processing to become dominant in the national economy. The domestic market can also be controlled by national downstream industry players and not controlled by foreign companies as is the case with downstream products from other industries. Ultimately, sustainable growth and control of the national downstream palm oil industry can be achieved.